By Lydia DePillis and Eric Umansky, ProPublica

ProPublica is a Pulitzer Prize-winning investigative newsroom. Sign up for The Big Story newsletter to receive stories like this one in your inbox.

Series: Coronavirus

The U.S. Response to COVID-19

A few weeks ago, a ProPublica reporter decided to test his kids for COVID-19. They had the sniffles, and with a grandparent set to visit he wanted to minimize the risk that they were infectious.

This was the problem that quick, cheap COVID-19 tests were supposed to help fix. No need to go to a clinic or wait days for results. Just pick up a pack of tests at a local pharmacy whenever you want, swab your nose and learn within 15 minutes if you're likely to pass the virus along.

So the ProPublican went to his neighborhood CVS, hoping to buy the required pack of two for $23.99. They were out of stock. Then he went to Rite Aid. They didn't have the tests either. Then Walgreens, then another CVS. All out of stock. The only supplier with a few tests to offer was his sister, who happened to have a few tucked away.

It's a familiar experience for many Americans. But not for people in Britain, who get free rapid tests delivered to their homes on demand. Or France, Germany or Belgium, where at-home tests are ubiquitous and as cheap as a decent cappuccino.

So why are at-home tests still so pricey and hard to find in the United States?

The answer appears to be a confounding combination of overzealous regulation and anemic government support — issues that have characterized America's testing response from the beginning of the pandemic.

Companies trying to get the Food and Drug Administration's approval for rapid COVID-19 tests describe an arbitrary, opaque process that meanders on, sometimes long after their products have been approved in other countries that prioritize accessibility and affordability over perfect accuracy.

After the FDA put out a call for more rapid tests in the summer of 2020, Los Angeles-based biotech company WHPM, Inc. began working on one. They did a peer-reviewed trial following the agency's directions, then submitted the results this past March.

In late May, WHPM head of international sales Chris Patterson said, the company got a confusing email from its FDA reviewer asking for information that had in fact already been provided. WHPM responded within two days. Months passed. In September, after a bit more back and forth, the FDA wrote to say it had identified other deficiencies, and wouldn't review the rest of the application. Even if WHPM fixed the issues, the application would be “deprioritized," or moved to the back of the line.

“We spent our own million dollars developing this thing, at their encouragement, and then they just treat you like a criminal," said Patterson. Meanwhile, the WHPM rapid test has been approved in Mexico and the European Union, where the company has received large orders.

An FDA scientist who vetted COVID-19 test applications told ProPublica he became so frustrated by delays that he quit the agency earlier this year. “They're neither denying the bad ones or approving the good ones," he said, asking to remain anonymous because his current work requires dealing with the agency.

FDA officials said they simply want to ensure that rapid tests detect even low levels of the virus, since false negative test results could cause people to unwittingly spread the disease. They blame the test shortages on an absence of the kind of sustained public funding that European governments have provided. Without it, manufacturers have lacked confidence that going through the FDA's process would be financially worth the trouble.

“Where we have seen tests truly coming to the marketplace, the big difference has been government investment," said Dr. Jeff Shuren, head of the FDA's Center for Devices and Radiological Health, which authorizes tests. “Folks will come and do larger volumes because you're supporting production, which can also help drive down prices."

Both the Trump and Biden administrations banked on vaccines putting a swift end to the pandemic, holding off on large-scale purchases of COVID-19 tests that Americans could keep in their medicine cabinets.

As a result, one of the few companies that has successfully gotten tests authorized and onto shelves — Abbott Laboratories — has dominated the market. Its BinaxNOW tests account for around 75% of U.S. retail sales, according to data from NielsenIQ, even though they're sold here for several times the price of the same Abbott tests in Europe.

In the past two months, the Biden administration has takensteps to make home tests more widely available. As more tests are authorized and more purchase orders are signed, pharmacy shelves are starting to fill up.

But that still may not be enough, as manufacturers scramble to build supply chains capable of delivering the tens of millions of tests per week that public health experts estimate will be necessary to keep schools and workplaces open and safe. Employers charged with testing their entire workforces have found themselves in bidding wars in order to secure adequate supply.

As with the slow ramp-up of lab testing at the beginning of the pandemic, the delays have come with a cost.

“It feels like in one place we're in a rocket ship and in another place we're on training wheels," said Rep. Kim Schrier, D-Wash., contrasting vaccines and testing. Schrier, a former pediatrician who has been pushing the agency to authorize more rapid tests, said, “You can't count on the free market during a pandemic."

The U.S. testing response has been troubled from the beginning of the pandemic, seesawing between caution and overcorrection.

In February 2020, the Centers for Disease Control and Prevention took weeks to develop its own test, which later turned out to have falsely flagged other viruses, allowing the one that causes COVID-19 to gain a foothold in the U.S.

Then the FDA became more permissive, allowing privately developed tests that detected antibodies from previous infections to enter the market after only cursory review. When dozens of the tests turned out to be inaccurate, the FDA prohibited their use.

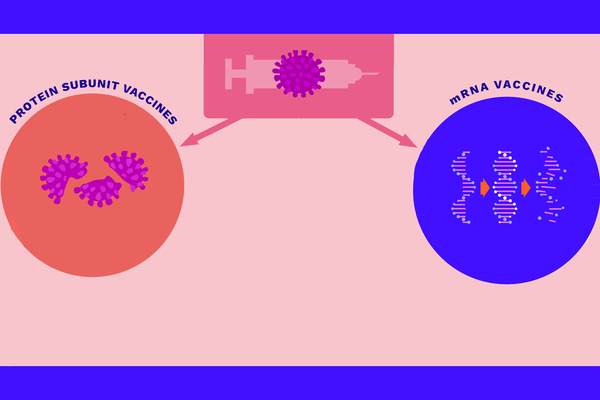

Meanwhile, the FDA grappled with thousands of applications for “emergency use authorizations," or EUAs. The process for EUAs is less involved than for full approval but still requires extensive clinical and real-world evaluation. Most EUAs issued have been for PCR tests, which are highly sensitive — meaning they can detect even low levels of the virus — but typically take days to return results.

Another form of diagnostics, antigen tests, can return results quickly and cheaply, similar to a pregnancy test. They're less sensitive, but usually good enough to determine whether someone is infectious.

Recognizing the potential market for antigen tests, companies began submitting more EUA applications in late 2020. But the FDA was wary about this type of test, mostly warning of the danger of false negatives in the earliest stages of infection.

FDA officials were particularly concerned about allowing tests to be administered outside the purview of a trained health care provider. “To mitigate the impact of false results, all Covid-19 tests authorized to date have been made available only by prescription, so that clinicians can interpret results for patients," wrote Shuren and his deputy Dr. Tim Stenzel in an October 2020 column in The New England Journal of Medicine.

That cautious approach persisted all through the winter and early spring, despite rising agitation from the White House and Congress around the availability of tests.

“I actually have been saying that for months and months and months, we should be literally flooding the system with easily accessible, cheap, not needing a prescription, point of care, highly sensitive and highly specific" tests, White House chief medical advisor Dr. Anthony Fauci said under questioning from Schrier in a hearing on March 17.

Stenzel, a microbiology Ph.D. who in 2018 became director of the office that authorizes diagnostic tests, holds the most day-to-day power over whether a test gets approved. He worked at biotech companies for most of his career before coming to the FDA, leading some to wonder if those prior relationships played a role in determining which testmakers became the most important players in the market.

Among Stenzel's former employers were Abbott and the San Diego-based Quidel Corporation, the first two companies to sell self-administered, prescription-free COVID tests in large volumes.

Quidel CEO Doug Bryant said in a promotional video that in early 2020, the company wasn't planning on designing a COVID-19 test until he got a call from a trusted contact at the FDA. That contact was Stenzel, the agency confirmed.

Quidel and Abbott had their at-home tests approved about a year later. On an earnings call, Quidel's Bryant said it was “the most significant inflection point for our company." In the third quarter of 2021, Quidel made $406 million from its various COVID-19 tests, blowing past Wall Street's expectations. “There is no denying Quidel has put itself in position to win big in COVID-19 testing," wrote an analyst with the firm William Blair. Abbott made $1.9 billion globally on its COVID-19 tests.

Ethics disclosures show that Stenzel holds no Abbott or Quidel stock, and it's been several years since he worked at either company. But Stenzel's ties to the two major test manufacturers and the slow pace of authorizations for other companies' at-home tests drew a letter from an anti-monopoly think tank, the American Economic Liberties Project, calling for an investigation.

Stenzel denied any improper conduct, and pointed out that his office issued recalls to both Abbott and Quidel for problems with other COVID-19 tests. He also noted that the office designed relatively easy-to-follow templates for new types of COVID-19 tests to help companies that hadn't dealt with the FDA before.

“We understood that there were a bunch of companies that were new to the FDA, and we provided them an immense amount of support, saying, 'This is how you do it,'" Stenzel said.

The FDA has said it “engaged with more than 100 test developers" about making diagnostics. The agency declined to provide the names, citing confidentiality concerns.

Quidel acknowledged the administration had reached out, but didn't comment on its discussions with Stenzel, while Abbott said it had spoken to “many people across multiple areas of government" early in the pandemic.

Most companies don't have the same familiarity with the people adjudicating their applications.

Nanōmix, a diagnostics designer based in Emeryville, California, developed a rapid test with the help of a federal grant and submitted it to the FDA in February. In early June, an FDA reviewer sent back a list of questions, giving Nanōmix a deadline of 48 hours to respond. The company couldn't provide answers that quickly, so it was sent to the back of the line.

“We start development on a set of guidance," said Nanōmix CEO David Ludvigson. “Then they change the guidance after we're done, and expect us to have conformed to their revised guidance."

The FDA has been particularly circumspect with more novel approaches to testing, such as an olfactory test that detects the common COVID-19 symptom of loss of smell. The agency's reviewers deprioritized an application for the scratch-and-sniff card even though it had been proven to stem transmission, said inventor Derek Toomre, a professor at the Yale School of Medicine.

Other companies, big and small, have been tripped up by FDA demands that seem minor in view of the urgency of the situation.

For example, the biopharmaceutical giant Roche told ProPublica that it submitted a home test in early 2021, but it was rejected by the FDA because the trials had been done partly in Europe. The test had comparedfavorably with Abbott's rapid test, and received European Union approval in June. The company plans to resubmit an application by the end of the year.

A smaller company, which didn't want to be named because it has other contracts with the U.S. government, withdrew its pre-application for a rapid antigen test with integrated smartphone-based reporting because it heard its trial data from India — collected as the delta variant was surging there — wouldn't be accepted. Doing the trials in the U.S. would have cost millions.

The FDA reviewer who quit this May described what the delays looked like from the inside. With a background in virology, he could evaluate the hundreds of pages in an application within a few days. But then, something strange happened: The applications would go nowhere for months as higher-up officials seemed paralyzed by indecision.

“I could easily process dozens of them, but I ended up with one or two in my queue constantly. They would stay there forever," he said. “I had a lot of free time."

His experience is reflected in an outside review of the EUA process conducted by the consulting firm Booz Allen Hamilton, which found that the median number of days it took the FDA to issue a decision on original applications rose to 99 in November 2020 from 29 the previous April, with denials taking substantially longer than authorizations. The assessment also found “limited understanding in the test developer community on how to appropriately validate a diagnostic test."

Stenzel said that any delays were a consequence of careful review, and that the office received many applications that were incomplete or had shoddy data.

“If we have questions or concerns about a test, they will not be prioritized the same way a test will be that we have fewer questions about," Stenzel said. “Those will be cycled to the front, and it makes good public health sense to move forward those tests that are most likely to pass muster and get authorized. ... There are always good reasons for why something is delayed."

European countries generally maintain similar guidelines for the accuracy of tests, but are less particular about how trials must be conducted. For example, test developers are allowed to limit their samples to subjects with high viral loads, for whom antigen tests perform better.

The FDA, however, remains concerned that the typical method for measuring viral load isn't consistent, leading to the risk of overestimating the accuracy of the test. Advocates of the European approach point out that being able to identify an infection in its earliest stages won't help much if a PCR result doesn't come back for days, so even a less sensitive at-home antigen test is valuable — especially since people are much more likely to be able to access them in the first place than PCR tests.

Europe's differing approach has resulted in 39 rapid self-administered antigen tests being authorized by the European Union, according to a database maintained by Arizona State University. The U.S. has authorized 12, nine of which are available without a prescription.

A consultant who works with smaller companies trying to get products through the FDA — and who asked for anonymity in order to protect his clients who have business before the agency — said he understands the argument that more robust applications from companies with larger manufacturing capacity should go first.

The problem with this logic, he said, is that it's now fall and the pandemic is ongoing, with the possibility of new variants still unknown. “And it's not like you can flip a switch with the Defense Production Act and you're going to get magically much more capacity," he said. “We needed a 'thousand flowers bloom' approach. We needed everyone and their brother pitching in with these tests."

The federal government could also have buttressed the supply of rapid COVID-19 tests by purchasing large quantities from companies able to manufacture them in bulk, and then providing them to consumers at low or no cost.

Shuren and Stenzel recommended as much a year ago in their New England Journal of Medicine column. They wrote that the U.S. government should have authorized a handful of tests and had the CDC contract with those manufacturers, rather than trying to vet thousands of diagnostics, which they called “an inefficient use of resources."

European countries essentially did both, authorizing dozens of rapid antigen tests to be sold while contracting with a few companies to provide millions of them free of charge to individuals. The U.K., for example, allocated $50 billion over two years to set up a national test and trace program that delivers rapid tests to anyone upon request. It hasn't worked perfectly or averted lockdowns, but advocates argue it's better than the U.S. alternative of rapid tests being nearly impossible to find.

For Germany's free testing program, which ran from March through October, the government initially bought 800 million rapid tests and 200 million home tests from a shorter list of manufacturers that had undergone additional vetting. The country also required the unvaccinated to present fresh test results for most activities that involve congregating with other people.

Although the U.S. government has spent billions of dollars on testing — estimates of the total vary, given the number of funding streams — self-administered tests are usually not covered by insurance, and there is no centralized system for distributing them.

In the late winter and early spring of 2020-21, the federal government spent hundreds of millions of dollars to buy point-of-care tests, but they were mostly reserved for use in facilities like nursing homes and military bases. The economic stimulus bill that passed in March allocated $10 billion for screening in schools, which don't usually rely on home tests. Then, the focus shifted to vaccines.

In May, the CDC leaned hard into the message that vaccines were almost completely protective, mitigating the need for frequent testing. Manufacturers took that as a bad sign for testing volume. Abbott ramped down manufacturing of its popular home test.

At that time, Stenzel seemed satisfied with the availability of tests. “We believe we're doing a great job at meeting the public health need at this point," he said in June on his weekly town hall call with test developers.

With no long-term government purchasing programs in place, companies had less interest in getting new tests through the pipeline, making it difficult for even promising concepts to get commercial pickup. With the help of a federal grant meant to accelerate COVID-related technologies, Iowa State University professor Nigel Reuel developed a mailable paper test in April, but he said he's not sure it'll be worth it to take the step of clinical trials.

It's really hard, Reuel said, for a company to “say we're going to invest tons in this when we don't know what the long-term market for it is."

All this meant that when the delta variant hit in July, not only were PCR appointments suddenly hard to get, but home tests became vanishingly rare and reliant on a single manufacturer: Abbott, whose BinaxNOW test peaked during late summer at 90% of the market in retail over-the-counter sales. That dipped somewhat in September, when a few additional companies were able to get on shelves.

On an earnings call in October, Abbott CEO Robert Ford said the company anticipated dropping its price to maintain its market share, but wouldn't if competition didn't make it necessary.

Asked why its rapid tests are abundant and cheap in Europe and scarce in the U.S., Abbott spokesperson John Koval chalked it up to Europe's public support, both in its regulatory system and through government funding.

“It has taken more than a year for the American public, scientific experts and academia to accept the important role of rapid testing in the U.S.," Koval said. “Overseas, that was not the case, because the value of rapid testing was better understood prior to the pandemic."

Sentiment in Washington has been changing. In late October, Sen. Dick Durbinsent a letter urging “appropriate flexibility in regulatory standards" for at-home tests. And over the past month, the White House has thrown more weight behind rapid testing, announcing $1 billion in purchase commitments for home tests. Recognizing the difficulty of quickly securing the necessary volume of raw materials for tests, the Department of Health and Human Services awarded another $560 million to 13 companies for test components like swabs, pipette tips, packaging and other production capabilities.

Still, some of the government's efforts haven't added up to much.

In September, the White House announced that Walmart, Amazon and Kroger would sell COVID-19 tests at cost for the following three months. But no subsidy was involved, and for most of the first two months, the retailers were often out of stock. Tests available online are often sold by third-party distributors, and Amazon and Walmart said they don't control those prices, so they remain high.

At CVS, which didn't participate in the agreement with the White House, a Quidel kit — which costs $12 wholesale — still sells for $23.99.

Same with Rite Aid, but when one of us visited a store in Brooklyn this Wednesday, employees said they hadn't received a shipment of BinaxNOW kits in a month, until they got seven the day before. “They immediately sold out. And that was limiting it to one per person," said Roxanne, a pharmacy technician who declined to give her last name.

Meanwhile, the U.S. is moving to take on more responsibility over the validation of tests. Last week, the National Institutes of Health announced a new program to do much of the work for test developers, mitigating the back and forth around what's good enough. That resembles the process run by some European governments, although Shuren said the U.S. will still maintain tougher standards.

All of those steps would have been more helpful when experts began calling for them a year ago.

“We need to have a rethinking, during and after this pandemic, to talk about the role of testing," said Mara Aspinall, who co-founded the Biomedical Diagnostics program at Arizona State University's College of Health Solutions. “It's a fundamental piece of our fight. And that was realized too late."

Do you have information about COVID-19 testing that we should know? Email lydia.depillis@propublica.org or message her on Signal at 202-913-3717. Email eric.umansky@propublica.org or message him on Signal at 917-687-8406.